Is the deadline for filing your Income Tax Return coming closer day by day? As most of the people rush to file their tax returns, here is everything you need to know about Income Tax Login which will help you file your income tax returns online.

The last date for filing your income tax return in India is 31st July for individuals while it is 30th September for all businesses. With the deadline coming closer each day, it is high time that you filed your Income Tax Return to the Government. Here is a comprehensive account of everything you need to know about the login details of Income Tax for filing your Tax Return.

What is Income Tax Login?

The Indian government recently banned the notes of Rs 500 and Rs 1000 in November 2016, in an attempt to push the economy towards digital modes of payments. Not only this, the government is asking people to file their income tax returns online for quite some time now. You require login details of your account on the Income Tax department’s portal for e-filing, to file for your Tax Returns. These login details are made up of your User ID and password, where your PAN number acts as the User ID while you generate the password for your account during the registration process.

Why do you need Login details to file Income Tax?

Login details help to confirm your identity online. With cybercrime rates at an all-time high, the Indian Government has established unique login details for each citizen, which makes it super easy for you to file your Income Tax Return. You need your login details for a number of things:

- To file your Income Tax Returns online, using the government website and your login details.

- To keep track of your tax returns, payments and refunds (if any).

- To calculate your annual TDS and Income Tax Return at the end of the economic year.

How to use your Login details?

You can use your Income Tax Login details to log into your account online to file your income tax return. Here is a step by step guide that will help you along the way.

- Visit the website – http://www.incometaxindiaefiling.gov.in/

- Click on the Login button at the right side of the webpage.

- You will be redirected to a login page. Here you can enter your login details and enter into your account.

If you do not have a registered account, follow the procedure given below:

- Visit the website – http://www.incometaxindiaefiling.gov.in/

- Click on the ‘Register Yourself’ link on the right side of the webpage

- A new page will open with a registration form. Select your user type and click on ‘Continue’.

- On the next page, enter your personal details. These details must correspond with the details present on your PAN card. Click ‘Continue’ to proceed.

- Provide anemail id and phone number that you currently use.

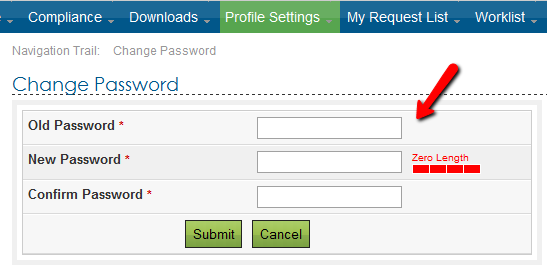

- Make a smart password for your account that is tough and select primary and secondary questions for future account recovery.

- Next, you will be asked to fill in your residential details. After you have done so, click on ‘Submit’. The webpage will then redirect you to a confirmation page.

- Next, you will be asked to fill in your residential details. After you have done so, click on ‘Submit’. The webpage will then redirect you to a confirmation page.

- You will be asked to enter the OTP received on your mobile. Click on ‘Submit’ after entering the OTP.

- If everything goes as expected you will see a webpage that says “The User ID is successfully activated”.

- You can now use your login details to log in to your account.

Income Tax Login is very important, and it can help you login to your income tax account for accessing your ITR-V. You can also view all your e-filed returns and can even verify all your tax returns using these details. Make sure you keep your login details safe and away from prying eyes.