Contents

HIGHLIGHTS

- GST will impact bike prices marginally

- Ex-showroom prices of bikes below 350 cc will go down

- Ex-showroom prices of bikes above 350 cc will increase

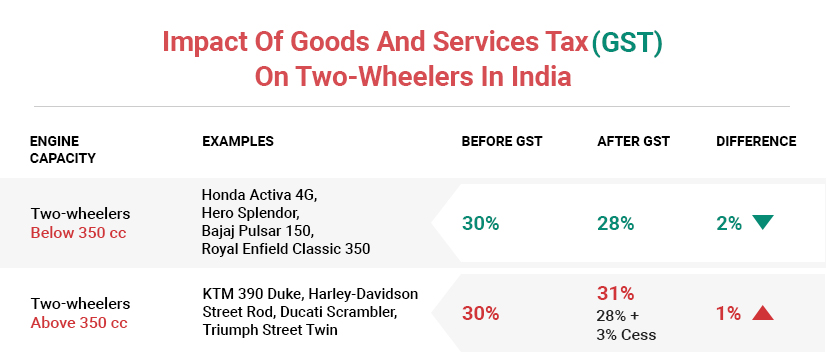

GST effect on bikes will impact prices of two-wheelers once Goods and Services Tax (GST) is implemented from 1 July 2017, but only marginally. GST leads to a more unified tax structure, so two-wheeler manufacturers will charge a uniform price across India. This will result in ex-showroom prices of two-wheelers becoming same across India, with a flat 28 per cent GST. But the GST structure for two-wheelers have been classified into two groups – two-wheelers with engines below 350 cc and two-wheelers with engines above 350 cc.

GST slabs and impact on two-wheeler prices

So, GST effect will have two-wheelers with engine capacity below 350 cc will attract a flat 28 per cent, down 2 per cent from the current 30 per cent in various taxes, including excise duty, VAT, CST, etc. This slab includes all Royal Enfield 350 bikes which have actual engine capacity of 346 cc. But two-wheelers above 350 cc engine capacity will attract an additional cess of 3 per cent, over and above the 28 per cent GST. So, the eventual tax difference will be roughly around 1 per cent when the GST impact on prices will come into place.

GST effect on bikes: Royal Enfield Classic 350 is expected to cost less

So, after GST on bikes come into place, bikes like Royal Enfield Himalayan, Royal Enfield Classic 500, KTM 390 Duke, KTM RC 390 will cost marginally more. This GST slab will also include all premium bikes from manufacturers like Triumph, Ducati and Harley-Davidson since all models of these manufacturers have engines displacing more than 350 cc. In fact, all premium bikes will have an additional 3 per cent cess.

A few manufacturers like Bajaj Auto and Royal Enfield have already announced GST discounts on bikes. TVS Motor Company has also said that GST benefits on bikes will be passed on to customers and even Honda Motorcycle and Scooter India has said that GST benefits will be passed on to customers in the form of price cuts. But how much different will the GST impact on bikes be? Here’s how ex-showroom bike prices in India are likely to be affected by GST.

Prices of two-wheelers before and after GST

| ENGINE CAPACITY | EXAMPLES | BEFORE GST | AFTER GST | DIFFERENCE |

|---|---|---|---|---|

| Below 350 cc | Honda Activa 4G, Hero Splendor, Bajaj Pulsar 150, Royal Enfield Classic 350 | 30 per cent | 28 per cent | – 2 per cent |

| Above 350 cc | KTM 390 Duke, Harley-Davidson Street Rod, Ducati Scrambler, Triumph Street Twin | 30 per cent | 28 per cent and additional 3 per cent cess (Total 31 per cent) | + 1 per cent |

So, how will GST affect prices?

Under the current taxation structure, different states have different taxes, so prices are also different due to these individual taxes. GST aims to do away with this discrepancy in prices under a flat, countrywide tax, so prices will be uniform. But different taxes in different states under the pre-GST structure means that current prices are different in different states. For example, prices of premium two-wheelers in Delhi may increase marginally, but prices of the same two-wheelers may actually go down from current prices in states like Maharashtra, Gujarat and Karnataka, where they are currently high due to high state taxes and octroi.

Will bikes below 350 cc cost less eventually?

So far, there’s still no clarity on how the final prices will be different. Sure, GST will bring down the ex-showroom prices of automatic scooters, and all motorcycles which fall below the 350 cc category. Manufacturers are expected to announce new prices of their products under GST, just before 1 July 2017, when GST comes into place. But road tax doesn’t fall under GST, and insurance costs will actually rise with a 18 per cent GST, up from the current 12 per cent service tax. Eventually, for the consumer, on-road prices will more or less remain the same. What is expected to increase is maintenance, with both spares and service costs likely to increase under GST.

[“Source-auto.ndtv”]