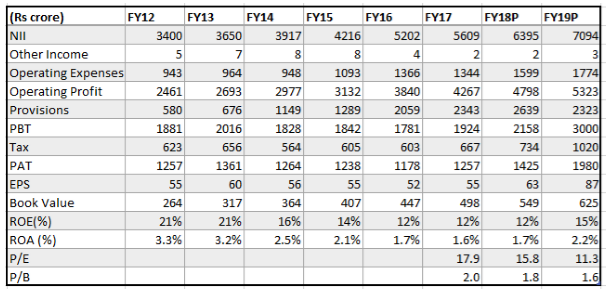

For Shriram Transport Finance, the last five years have been harrowing. In FY17, the company ended the year with a profit of Rs 1257.3 crore – identical to the profit of Rs 1257.4 crore reported in FY12. Does the future look better? Perhaps yes, but the wait may be a bit longer.

Difficult Past

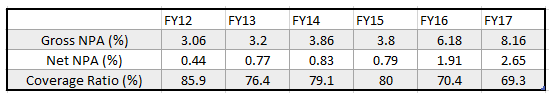

The weak performance over the past five years had been primarily on account of mounting asset quality woes. From FY12 to FY17, gross NPAs more than doubled from 3.06 percent to 8.2 percent and the consequent provisioning dented its profitability. The net NPA over the same period leapt from 0.44 percent to 2.66 percent. The only redeeming feature was the company’s stance of not compromising on the provision cover.

The once enviable used-vehicle financier was also hit by RBI’s directive to recognise slippages on par with banks (i.e. on a 90-day past due basis) from March 2018. The migration to the new norm coupled with the significantly challenged asset quality of its subsidiary Shriram Equipment Finance (amalgamated into the company from FY16) had severe impact on the financials.

With multiple moving parts in the economy along with the added complexity of GST, does the future hold promise?

In the short-term, we do not expect the reported numbers to look up as the target segment of commercial vehicle owners readjust life with the new reality of GST.

Shriram’s forte is the used-vehicle segment catering to small truck owners (less than 5 trucks) with underdeveloped banking habits. About 90 percent of the vehicles financed are used vehicles with a skew towards vehicle vintage of 5 to 10 years. The adjustment of the users with the new tax changes might lead to short-term disruptions.

Shriram has migrated to 120-day NPA recognition from the fourth quarter. FY18 will witness the migration to 90-day recognition that might add another 150 basis points to the existing gross NPA of 8.16 percent. Although the provision coverage ratio might come down from 70 percent to 60 percent, the migration nevertheless will impact profitability.

The company, however, has guided to a decent 10-12 percent loan growth banking on the recovery in agriculture and an increase in vehicle cost due to implementation of the BS-IV norms that will impact the pricing for the older vehicles as well.

Tailwinds From FY19

However, we see numerous tailwinds emerging from FY19.

The logistics backend is likely to undergo a sea change post the implementation of GST. The warehouse rationalisation that will emerge on account of GST on inter-state movement will lead to the emergence of the hub-and-spoke model. Vehicles will not just be used for transporting but also for quasi-warehousing.

The increased movement on account of the hub-and-spoke model will result in demand for heavy vehicles as well as a large number of LCVs for last mile connectivity. Shriram’s target market of small fleet owners will typically fall under the Composite Scheme (turnover up to Rs 75 lakh) and will bear a lower incidence of tax and will continue to find favour with large fleet owners who prefer to run an asset-light model of taking vehicles from the smaller operators.

According to Umesh Revankar, MD & CEO of Shriram Transport, 85 percent of the vehicles financed by the company transports daily needs and would not face much of a capex-linked headwind.

On the asset quality front, post the migration to 90-day norm, we expect the asset quality deterioration to peak out and from FY19, provisioning requirement should abate. The management expects a 50 basis points reduction in credit cost in the next two years.

Shriram also bore the brunt of relatively high cost of funds in the past. A gradual decline in cost of funds over the next two years as the incremental cost of current borrowings is much lower which should also have a positive rub-off on margin.

Lower credit cost coupled with uptick in margin should reflect in healthy improvement in the return ratios.

While the recent spate of farm loan waivers might unnerve investors, Shriram management feels that with a reasonably low loan to value ratio of 60 percent, the incentive to default is low and with a monthly payment cycle, vehicles are usually repossessed early which is not the case with a farm loan.

On the business side, too, some of the initiatives might bear fruits in the medium-term.

To expand its business from the “unbanked” target market, Shriram has been building partnerships with private financiers in the unorganized market to leverage their local knowhow to enhance market share. They typically charged a much higher rate but post demonetisation their business case had weakened considerably. A part of the margin as well as credit loss will be shared between Shriram and the private financiers.

The company also sees scope in the mapping of load for commercial vehicles and has tied up with Blue Dart for mapping of load in its network. It expects this business to catch up as all new vehicles are going to come with navigation devices.

Time to Repose Faith?

Buffeted by multiple tailwinds, Shriram Transport has been a big underperformer – the stock has fallen by 14 percent in the last one year against a 17 percent rally in the Nifty Index. However, with a savvy investor like Piramal owning 10 percent in the company and multiple tailwinds in the horizon, it is time to give it a serious thought.

At the current market price, the stock trades at relatively undemanding valuation of 1.6X FY19 book.

[“Source-moneycontrol”]