Most of priority sector loans are supposed to serve a social purpose and they are meant to ensure that credit flows to those sections of society whom the banks may otherwise neglect. Photo: AFP

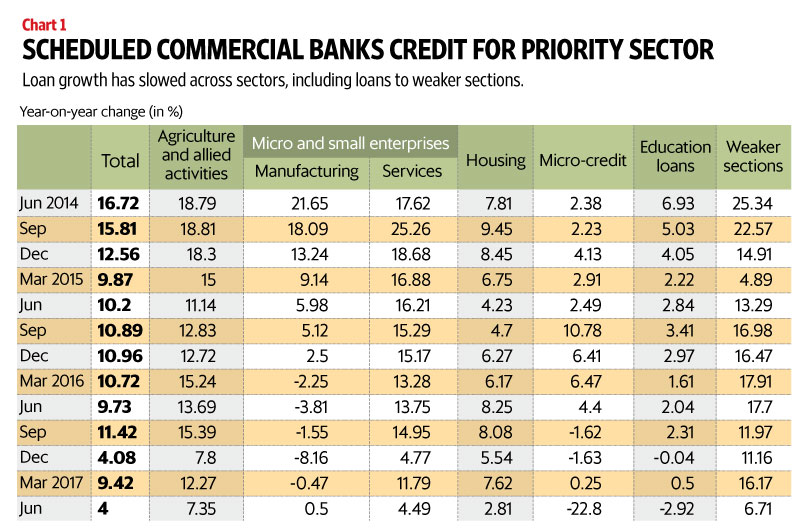

It’s not just lending to the beleaguered corporate sector that has slowed—bank credit growth to the priority sector too has fallen considerably in recent months. The priority sector includes lending to agriculture, lending to micro and small enterprises in the manufacturing and services sectors, education and low-cost housing loans, loans to the weaker sections of the population and export credit.

Most of these loans are supposed to serve a social purpose and they are meant to ensure that credit flows to those sections of society whom the banks may otherwise neglect. Chart 1 has the details.

Overall bank credit growth to the priority sector was at 4% in June and it has been slowing steadily. One reason is that inflation rates too have come down. But that is far from explaining the entire fall.

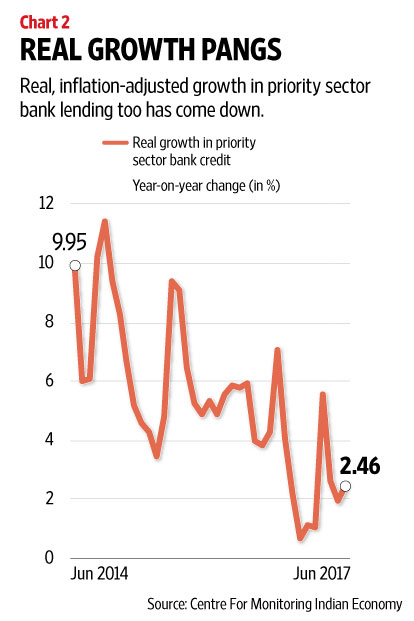

Chart 2 below shows the real year-on-year growth in bank credit to the priority sector, after adjusting for consumer price inflation. It’s noteworthy that real growth in priority sector lending is well below the growth in the previous two years—the only period during which it was worse was during November to February 2017, which was the peak for the demonetization exercise.

If we consider the absolute numbers, the picture becomes dismal indeed. Loans outstanding to micro and small manufacturing enterprises in June 2017 were lower than the level they were at two years ago, in June 2015. Loans outstanding to the micro and small services sector is only marginally higher than the level at which it was in September 2016. It is very likely that these small businesses were badly hit first by the demonetization exercise and now by the disruption caused by the goods and services tax (GST).

Other priority sectors too have been hit. Loans to the low-cost housing sector by banks were lower in June 2017 than in September last year. The level of education loans in June 2017 was lower than in May 2016. But the bleakest picture is in micro-credit loans in the banking sector, which were lower in June 2017 than their level five years ago, in July 2012.

Even in agriculture and in lending to the weaker sections, real credit growth has been lower than last year and is nowhere near what it was in 2014. To take an example, real loan growth to agriculture was at 12% in June 2014 compared to 5.8% in June 2017. Real credit growth to the weaker sections was at 18.6% in June 2014 in contrast to 5.2% in June 2017.

The fact that lending to the priority sectors too has slowed down is a reflection of just how badly the bad loan problem has affected banks. What is more worrying is that a slowdown in lending in these areas could also have social repercussions.

[“Source-livemint”]