Investors have nothing but adulation for Bajaj Finance Ltd, which is visible in the outperformance of the stock compared to the broader market since last December.

The fact that the scrip gained more than 4% intraday on Thursday shows investors were happy with its fourth quarter performance. It closed the day with a gain of 3.6%. After all, net profit growth beat Street estimates to come in at 41% on a stand-alone basis, and 57% on a consolidated basis.

The growth is not hollow, because it came from a strong 50% expansion in core income, along with enviable asset quality metrics. The consumer lender’s disbursals continued to gallop across verticals, with its rural business leading as usual. Consumer loans, the mainstay of the lending business, grew by over 50% from the year-ago period, while loans to small businesses increased by 38%.

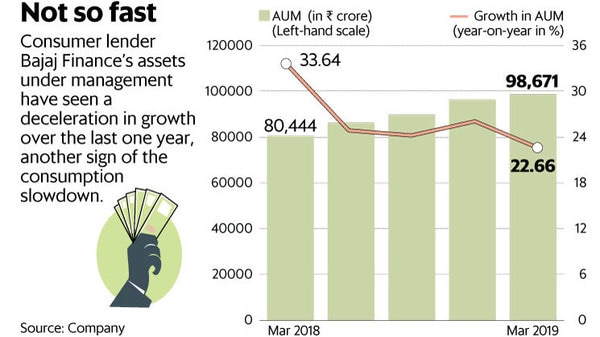

That said, the emerging narrative of a slowdown in consumption was visible on Bajaj Finance’s books too.

As shown by the accompanying chart, the AUM (assets under management) growth of the lender was 23% year-on-year for the March quarter. This was lower than the 33% growth in the year-ago period. The management said: “Consumption is slower, but it is also patchy.”

In a post-results call with analysts, the management added that signs of a marginal slowdown were visible in certain categories of loans, while other categories showed robust growth. However, on an aggregate, consumption has slowed.

Indeed, when the housing loan subsidiary is included, AUM growth has remained steady. Bajaj Finance’s infusion of capital into the subsidiary also shows that growth rates are expected to be high.

Even the reported stand-alone AUM growth is no small change when compared with low-double-digit growth by peers.

Also, one cannot fault investors from seeking refuge in a stock that gives them exposure to a proven business model, especially when other financiers lending to small businesses and real estate are not doing too well. More so, Bajaj Finance has delivered strong growth metrics consistently for several quarters now.

The lender has also managed to emerge unscathed from the liquidity crunch that still continues to haunt some non-banking financial companies. To be sure, it got nicked by the defaults of Infrastructure Leasing and Financial Services Ltd, but barely any pain was visible.

Bajaj Finance’s asset liability position is comfortable and nearly 13% of its borrowings are from retail deposits.

With more than 17% gain since January, the stock trades at a multiple of over five times its estimated book value for FY21, which according to analysts is rather rich.