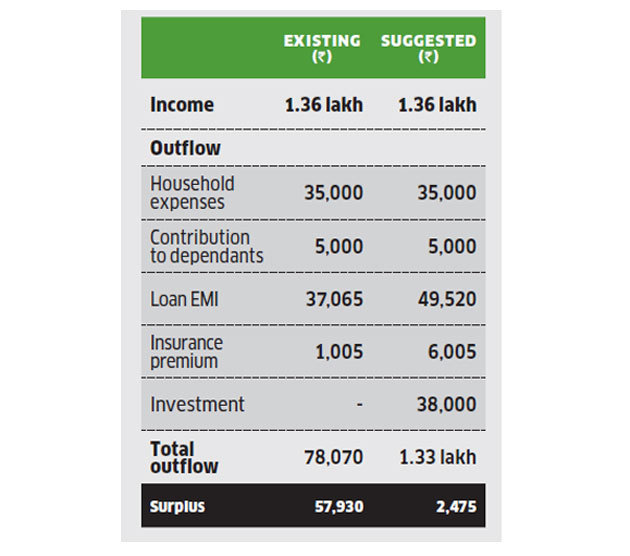

Kumar, 27, and Veta Birari, 28, are both software developers, who live in their own house, in Pune. They get a combined monthly salary of Rs 1.36 lakh, of which they are left with a surplus of Rs 57,930.

In order to achieve their goals, they will need to put this amount to work instead of letting it idle in the bank. Their goals include building an emergency corpus, saving for their future child’s education and wedding, buying a car and building a retirement kitty.

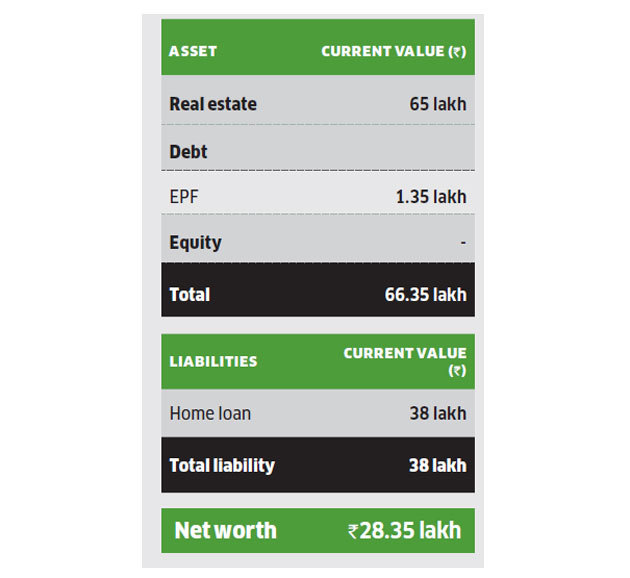

Since they have a meagre portfolio comprising a self-occupied house worth Rs 65 lakh and Rs 1.35 lakh in the EPF, they will have to make fresh investments to meet the goals.

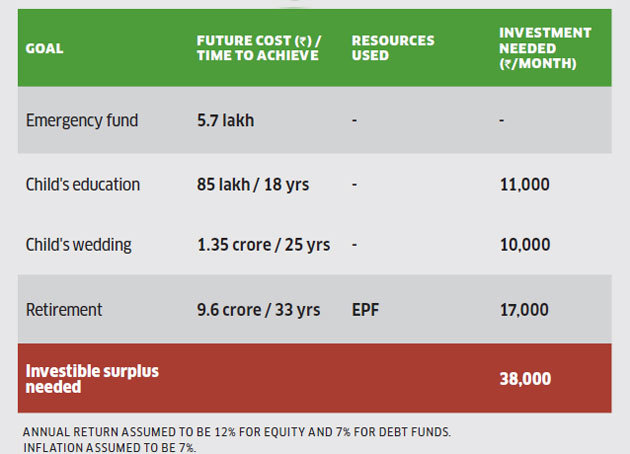

Financial Planner Pankaaj Maalde suggests that they start by putting in place a contingency corpus of Rs 5.7 lakh, which is equal to their six months’ expenses.

Since they don’t have any existing resource to allocate to this goal, they should save the entire surplus of Rs 38,000 for 15 months and invest this amount in an ultra short duration fund. They should begin investing for the other goals only after building this corpus.

Portfolio

Cash flow

Next, the couple wants to save for their future child’s education and wedding in 18 and 25 years, respectively. They have estimated a need of Rs 85 lakh and Rs 1.3 crore, respectively, for these goals. They will have to start fresh SIPs of Rs 11,000 and and Rs 10,000 in diversified equity funds for these.

As for retirement in 33 years, the couple will need Rs 9.6 crore and will have to allocate their EPF corpus for this. In addition, they will have to start an SIP of Rs 17,000 a month in diversified equity funds to be able to meet the goal.

How to invest for goals

Finally, the couple also wants to buy a car worth Rs 6 lakh in a year’s time. Since they don’t have the required funds or resources to allocate to this goal, Maalde suggests they take a loan for five years. At a rate of 9%, the EMI will come to Rs 12,455, which can be sourced from the surplus.

As for life insurance, Kumar has a term plan of Rs 60 lakh, but according to Maalde, he needs an additional cover of Rs 1 crore, while Veta needs a Rs 75 lakh cover. Both these term plans will come for a premium of Rs 1,833 a month.

Insurance portfolio

As for health insurance, Kumar has a Rs 3 lakh cover provided by his employer. However, he needs to buy an independent family floater plan of Rs 10 lakh as well as a Rs 5 lakh medical plan for his mother. Both these policies will cost him Rs 2,500 a month in terms of premium. In addition to these, both Kumar and Veta need to buy accident disability plans of Rs 25 lakh each, which will cost them Rs 667 a month.

[“source=economictimes.indiatimes”]